We offer a FREE VALUATION service for Executors and will prepare WRITTEN VALUATIONS for Probate on jewellery, gold, works of art and collectors items to provide the information required to complete the IHT407 form issued by HMRC regarding the valuation of jewellery, household and personal goods

When someone dies, Her Majesties Revenue and Customs (HMRC) need to know how much that individual was worth at the time of their death in order to calculate if any inheritance tax is payable. Proving the value of someone’s estate is referred to as a ‘Probate’ valuation. Currently, everyone is allowed to leave an estate valued at up to £325,000 plus the new ‘main residence’ band of £150,000 giving a total allowance of £475,000 per person. For estates valued under this their beneficiaries won’t pay inheritance tax, but tax will be liable at the rate of 40% on any amount over £475,000.

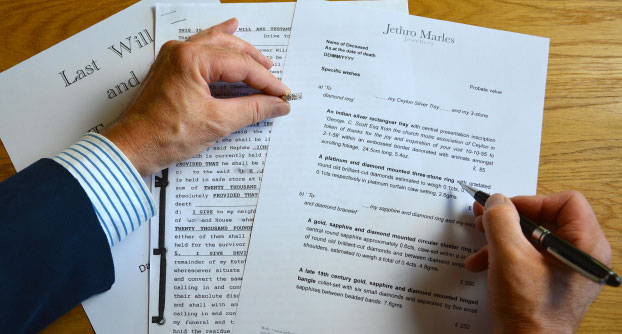

The individual given ‘Grant of representation’ or who has been appointed as ‘Executor’ of the deceased person’s estate will be required to obtain professional valuations for all items considered to be worth £1,500 or more.

We undertake valuations nationwide including the London and surrounding areas and across the South West of England encompassing Exeter, Torbay, Plymouth, Truro, Taunton, Barnstaple, Bournmouth and Bristol.

![executor-of-estate[1] executor-of-estate[1]](https://jethromarles.co.uk/media/executor-of-estate1.jpeg)